Convert XRechnung To PDF

Description

This action converts a valid XRechnung, Factur-X, or ZUGFeRD XML file (according to the EN 16931 standard) into a PDF invoice.

Input Arguments

| Input Argument | Type | Description | Required? | Advanced Option? | Default |

|---|---|---|---|---|---|

XRechnung | XML | The XML data of a valid XRechnung (Factur-X or ZUGFeRD based on EN 16931). | ✔️ | ❌ | - |

Output

| Response | Type | Description |

|---|---|---|

File response | The converted invoice as a PDF file | |

File response as string | String | The binary file content encoded as a string (for storing in Dataverse or variables). |

MIME type | String | The MIME type of the file (application/pdf) |

Extension | String | The file extension (always pdf) |

Power Automate Examples

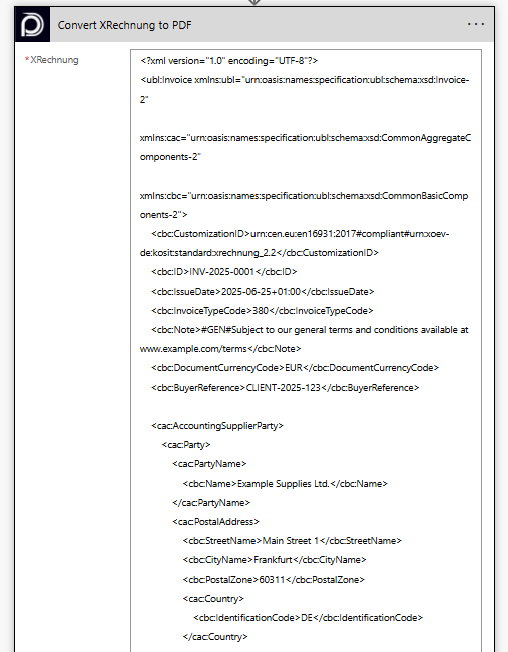

Convert XRechnung To PDF

Use an XRechnung XML file as input. It must comply with EN16931 and be based on Factur-X or ZUGFeRD.

XML XRechnung

<?xml version="1.0" encoding="UTF-8"?>

<ubl:Invoice xmlns:ubl="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2"

xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2"

xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2">

<cbc:CustomizationID>urn:cen.eu:en16931:2017#compliant#urn:xoev-de:kosit:standard:xrechnung_2.2</cbc:CustomizationID>

<cbc:ID>INV-2025-0001</cbc:ID>

<cbc:IssueDate>2025-06-25+01:00</cbc:IssueDate>

<cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode>

<cbc:Note>#GEN#Subject to our general terms and conditions available at www.example.com/terms</cbc:Note>

<cbc:DocumentCurrencyCode>EUR</cbc:DocumentCurrencyCode>

<cbc:BuyerReference>CLIENT-2025-123</cbc:BuyerReference>

<cac:AccountingSupplierParty>

<cac:Party>

<cac:PartyName>

<cbc:Name>Example Supplies Ltd.</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>Main Street 1</cbc:StreetName>

<cbc:CityName>Frankfurt</cbc:CityName>

<cbc:PostalZone>60311</cbc:PostalZone>

<cac:Country>

<cbc:IdentificationCode>DE</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>DE999999999</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>Example Supplies Ltd.</cbc:RegistrationName>

<cbc:CompanyID>HRB123456</cbc:CompanyID>

<cbc:CompanyLegalForm>GmbH</cbc:CompanyLegalForm>

</cac:PartyLegalEntity>

<cac:Contact>

<cbc:Name>Customer Service</cbc:Name>

<cbc:Telephone>+49 69 12345678</cbc:Telephone>

<cbc:ElectronicMail>info@example-supplies.com</cbc:ElectronicMail>

</cac:Contact>

</cac:Party>

</cac:AccountingSupplierParty>

<cac:AccountingCustomerParty>

<cac:Party>

<cac:PartyIdentification>

<cbc:ID>CLIENT-999</cbc:ID>

</cac:PartyIdentification>

<cac:PostalAddress>

<cbc:StreetName>Customer Road 45</cbc:StreetName>

<cbc:CityName>Berlin</cbc:CityName>

<cbc:PostalZone>10115</cbc:PostalZone>

<cac:Country>

<cbc:IdentificationCode>DE</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyLegalEntity>

<cbc:RegistrationName>Client Corporation AG</cbc:RegistrationName>

</cac:PartyLegalEntity>

</cac:Party>

</cac:AccountingCustomerParty>

<cac:PaymentMeans>

<cbc:PaymentMeansCode>58</cbc:PaymentMeansCode>

<cac:PayeeFinancialAccount>

<cbc:ID>DE75512108001245126199</cbc:ID>

</cac:PayeeFinancialAccount>

</cac:PaymentMeans>

<cac:PaymentTerms>

<cbc:Note>Payable immediately without deduction.</cbc:Note>

</cac:PaymentTerms>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="EUR">19.04</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="EUR">272.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="EUR">19.04</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>7</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:LegalMonetaryTotal>

<cbc:LineExtensionAmount currencyID="EUR">272.00</cbc:LineExtensionAmount>

<cbc:TaxExclusiveAmount currencyID="EUR">272.00</cbc:TaxExclusiveAmount>

<cbc:TaxInclusiveAmount currencyID="EUR">291.04</cbc:TaxInclusiveAmount>

<cbc:PayableAmount currencyID="EUR">291.04</cbc:PayableAmount>

</cac:LegalMonetaryTotal>

<cac:InvoiceLine>

<cbc:ID>Product Subscription 2025</cbc:ID>

<cbc:Note>Includes 12-month digital access from Jan to Dec 2025</cbc:Note>

<cbc:InvoicedQuantity unitCode="XPP">1</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="EUR">250.00</cbc:LineExtensionAmount>

<cac:InvoicePeriod>

<cbc:StartDate>2025-01-01+01:00</cbc:StartDate>

<cbc:EndDate>2025-12-31+01:00</cbc:EndDate>

</cac:InvoicePeriod>

<cac:OrderLineReference>

<cbc:LineID>SUB-2025-01</cbc:LineID>

</cac:OrderLineReference>

<cac:Item>

<cbc:Description>Annual digital subscription to Example Magazine</cbc:Description>

<cbc:Name>Example Magazine Subscription</cbc:Name>

<cac:SellersItemIdentification>

<cbc:ID>MAG001</cbc:ID>

</cac:SellersItemIdentification>

<cac:CommodityClassification>

<cbc:ItemClassificationCode listID="IB">1234-5678</cbc:ItemClassificationCode>

</cac:CommodityClassification>

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>7</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="EUR">250.00</cbc:PriceAmount>

</cac:Price>

</cac:InvoiceLine>

<cac:InvoiceLine>

<cbc:ID>Shipping Charges</cbc:ID>

<cbc:InvoicedQuantity unitCode="XPP">1</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="EUR">22.00</cbc:LineExtensionAmount>

<cac:Item>

<cbc:Name>Shipping and Handling</cbc:Name>

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>7</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

</cac:Item>

<cac:Price>

<cbc:PriceAmount currencyID="EUR">22.00</cbc:PriceAmount>

</cac:Price>

</cac:InvoiceLine>

</ubl:Invoice>

💡

Looking for the response to this example? Scroll up to see the Output tab.

Known Limitations

⚠️

If you experienced other limitations please get in touch with us!